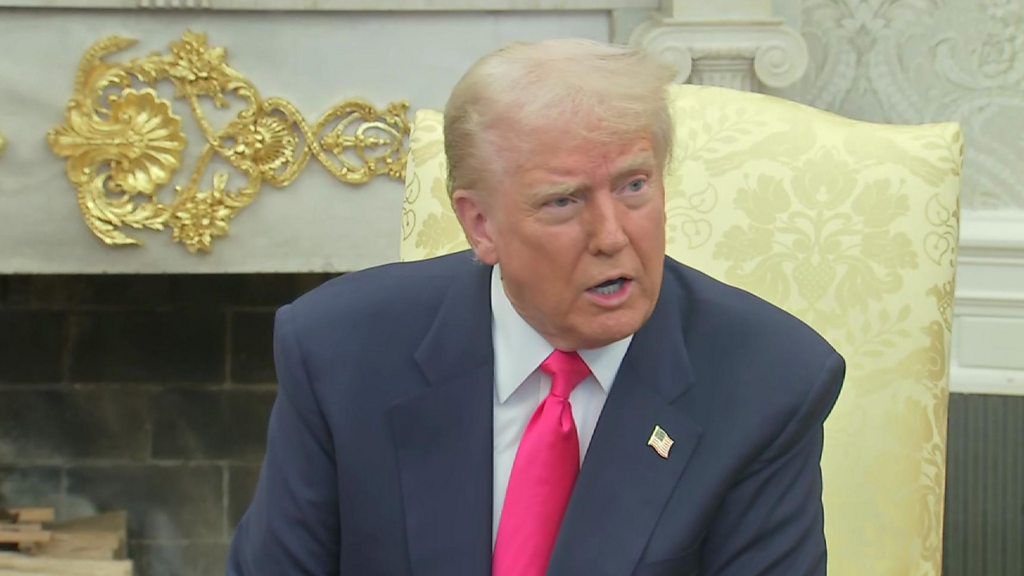

Former U.S. President Donald Trump has issued a stern warning to China, threatening to impose an additional 50% tariff on Chinese imports unless Beijing retracts its 34% retaliatory tariffs on American goods. The move signals a significant escalation in ongoing trade tensions between the two global economic powerhouses.

If the proposed tariffs are implemented, certain U.S. companies importing goods from China could face a combined tax burden of up to 104%. This would likely lead to higher prices for imported products and further strain American businesses that rely heavily on Chinese manufacturing.

The threat has already begun to shake investor confidence. U.S. stock markets opened to sharp declines, reflecting concerns over a deepening trade conflict and its potential impact on the global economy. Major European stock markets were also hit hard, with key indices such as London’s FTSE 100 closing more than 4% lower.

In a contrasting development, the European Union has offered a “zero-for-zero” tariff agreement on selected goods exported to the United States. This move appears to be an effort to stabilize transatlantic trade relations and avoid a similar escalation with Washington.

As global markets react, all eyes remain on how Beijing will respond to Trump’s ultimatum and whether this latest threat will push the two nations further into a prolonged trade war.