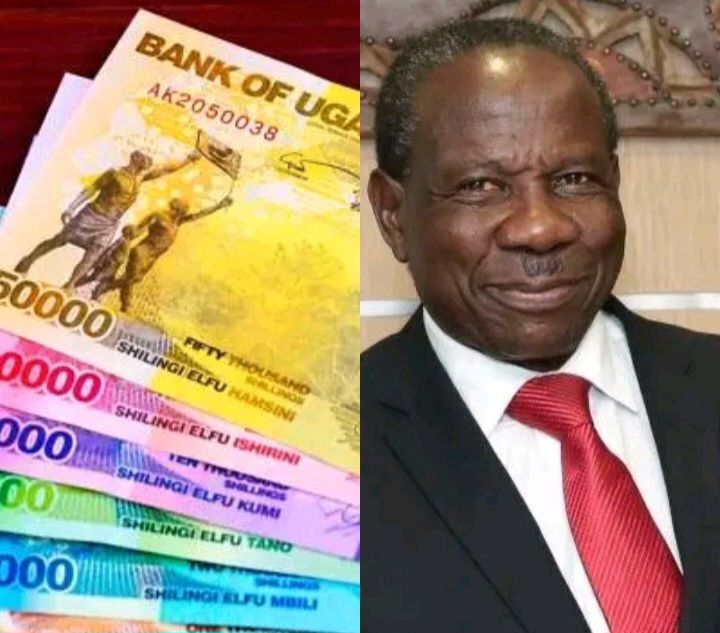

Uganda has made economic history with the Uganda Shilling emerging as East Africa’s best-performing currency, outpacing the Kenyan Shilling, Rwandan Franc, and Tanzanian Shilling against the US dollar.

The Shilling’s remarkable strength has drawn the attention of investors, economists, and the public, all keen to understand the factors behind its resilience. Analysts attribute the currency’s performance to robust foreign inflows, prudent monetary policy, and stable macroeconomic management by the Bank of Uganda.

Experts say strong fiscal discipline, prudent economic management, and consistent government intervention are among the key drivers behind the Uganda Shilling’s steady performance in both regional and global markets.

The Shilling’s sustained strength is viewed as a positive signal for Uganda’s economy, reflecting stability in trade, healthy foreign exchange reserves, and growing investment inflows. Businesses and consumers alike are benefiting from the relative firmness of the local currency, which helps temper import costs and inflation.

In contrast, neighboring currencies — including the Kenyan Shilling, Rwandan Franc, and Tanzanian Shilling — have faced continued pressure against the US dollar, underscoring Uganda’s unique position within East Africa’s financial landscape.

Analysts also highlight the resilience of Uganda’s economy amid global challenges such as inflationary pressures, supply chain disruptions, and volatile commodity prices. This resilience, they say, has helped shield the Shilling from sharp fluctuations affecting other regional currencies.

However, experts caution that while a strong currency supports price stability and boosts investor confidence, it may dampen export competitiveness in the short term by making Ugandan goods relatively more expensive abroad.

For ordinary Ugandans, the continued rise of the Uganda Shilling could translate into greater purchasing power for imported goods and services, including fuel, electronics, and agricultural inputs. The currency’s strength is also expected to bolster confidence in Uganda’s banking and financial institutions, reinforcing trust in the broader economy, reports The Observer.

However, economists caution that sustaining this momentum will require continued vigilance, prudent monetary policy, and close monitoring of global market trends to prevent sudden currency fluctuations that could impact investors and consumers alike.

Overall, the Uganda Shilling’s emergence as East Africa’s strongest currency marks a significant milestone in the country’s economic journey. Whether driven by sound economic management or broader market resilience, the development signals a promising outlook for Uganda, positioning it as a leader in regional financial stability.

Invest or Donate towards HICGI New Agency Global Media Establishment – Watch video here

Email: editorial@hicginewsagency.com TalkBusiness@hicginewsagency.com WhatsApp +256713137566

Follow us on all social media, type “HICGI News Agency” .